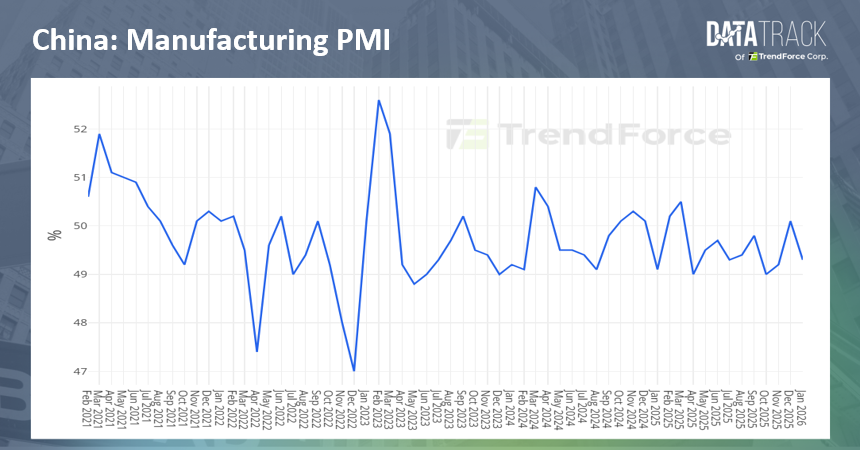

China’s National Bureau of Statistics reported that the Manufacturing Purchasing Managers’ Index (PMI) for January 2026 came in at 49.3%, down 0.8 percentage points from 50.1% in December 2025, officially falling below the 50 threshold and signaling that manufacturing activity has returned to contraction territory. The reading not only missed the market expectation of 50.1%, but also indicates that China’s economic growth momentum weakened in the previous quarter, marking a relative low since the lifting of COVID restrictions at the end of 2022 and pointing to softer momentum at the start of the year. While overall economic conditions remain relatively stable compared with the same period last year, the year-on-year trend has turned negative, highlighting the drag from weak domestic demand on the manufacturing sector.

Sub-index performance:

● The new orders index declined to 49.2%, down 1.6 percentage points month over month, signaling a notable slowdown in demand, mainly due to weak domestic consumption and a drop in export orders.

● The production index eased to 50.6%, down 1.1 percentage points, but remained above 50, indicating that manufacturing output continued to expand, albeit at a slower pace.

● The new export orders index fell to 47.8%, down 1.2 percentage points, reflecting volatility in global demand and rising uncertainty surrounding trade policies.

● The raw material inventory index slipped to 47.4%, down 0.4 percentage points, suggesting that destocking trends among manufacturers persist.

● The employment index remained below 50, pointing to weak labor demand, while the supplier delivery times index stayed above 50, indicating relatively stable supply chain conditions.

● The PMI for high-tech manufacturing stood at 52%, marking the 12th consecutive month of expansion, while the equipment manufacturing PMI registered 50.1%, highlighting continued support from new growth drivers and ongoing industrial upgrading.

The decline in PMI was mainly attributable to seasonal off-peak effects, insufficient effective domestic demand, and changes in the global trade environment. In addition, demand in certain industries was partly front-loaded by year-end performance pushes in late 2025. Meanwhile, rising commodity prices lifted the input price index to 56.1% (up 3 percentage points month over month), while the output price index rebounded to 50.6%, returning to expansion territory for the first time in nearly 20 months, helping to ease pricing pressures. Although the business confidence index softened, relatively optimistic expectations in high-tech sectors continue to provide resilience to the broader manufacturing landscape.

In summary, China’s manufacturing PMI fell below the expansion threshold in January 2026, signaling a more challenging start to the year. Nevertheless, production activity and high-tech manufacturing continue to demonstrate resilience. In the short term (1–2 months), manufacturing activity may remain under pressure due to the Lunar New Year holiday, with the PMI potentially retreating further to the 48.5–49.0 range. Over the medium term (within six months), increased fiscal stimulus and strengthened trade diplomacy could support a recovery in the PMI back above 50, keeping economic growth aligned with the 5% target, though rising risks from escalating US–China trade tensions warrant close monitoring.