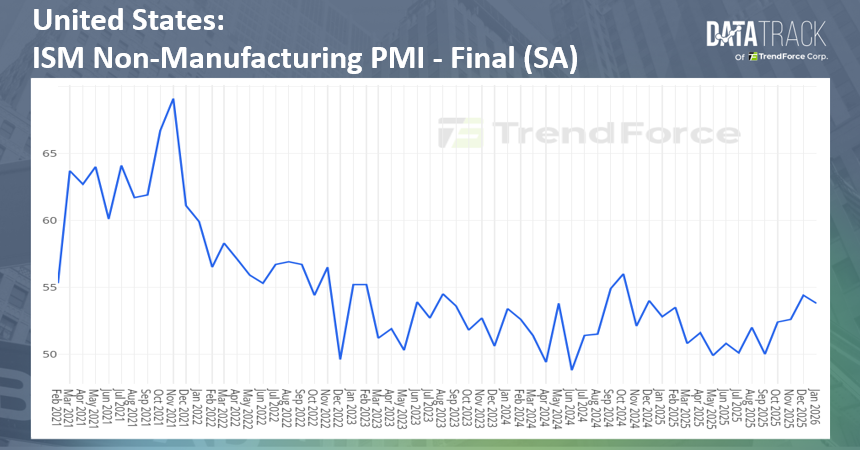

The Institute for Supply Management (ISM) released its January Services Purchasing Managers’ Index (PMI) on February 4, 2026, reporting a reading of 53.8, unchanged from the previous month and slightly above the market expectation of 53.5. The index has remained in expansion territory for 19 consecutive months and has stayed at a relatively elevated level for the second straight month since October 2024.

Remaining above the 50 expansion threshold, the Services PMI corresponds to an annualized contribution of approximately 1.8 percentage points to overall GDP growth, indicating that the U.S. services sector continues to underpin economic momentum. While new orders softened modestly, accelerating business activity and worsening supplier delivery delays point to resilient demand, with overall activity holding at high levels and showing no clear signs of deterioration.

Sub-Index Performance:

● Business Activity Index rose to 57.4, up 2.2 percentage points from the prior month, marking the fastest growth in 19 months, driven primarily by data center investment and holiday-related consumption.

● New Orders Index declined 3.4 percentage points to 53.1, but remained in expansion for the eighth consecutive month, supported by fiscal budget updates and the resumption of projects, although customer outlooks have become more cautious.

● Employment Index edged down 1.4 percentage points to 50.3, staying in expansion for a second month. Hiring increased in the construction and healthcare sectors, while recruitment was constrained by budget freezes in certain states.

● Supplier Deliveries Index increased to 54.2, up 2.4 percentage points month over month, marking the 14th consecutive month of slower deliveries, mainly due to chip shortages and strong data center demand.

● Prices Index climbed to 66.6, up 1.5 percentage points from the prior month, extending its expansion streak to 104 months, driven by higher copper product and labor costs, although declines in diesel and gasoline prices provided some offset.

● Inventories Index fell sharply to 45.1, down 9.1 percentage points month over month, shifting into contraction, largely reflecting inventory adjustments following year-end mandatory receipts.

● Backlog of Orders Index stood at 44.0, remaining in contraction for the 11th consecutive month but improving slightly by 1.4 percentage points; meanwhile, the New Export Orders Index dropped sharply to 45.0, down 9.2 percentage points, amid tariff-related uncertainty.

Overall, these developments reflect the combined impact of AI data center construction, concerns over tariff policy, and geopolitical tensions. Eleven industries reported growth, including healthcare, utilities, and retail, while five industries—such as transportation and wholesale trade—remained in contraction.

The January ISM Services PMI continued to signal expansion, underscoring the resilience of the U.S. services sector. Despite rising price pressures and weak export orders, strong business activity continues to support economic growth. In the short term (1–2 months), the PMI is expected to remain above 53, supported by data center investment and a recovery in consumer demand, though tariff uncertainty may weigh on new orders. Over the medium term (within six months), services sector growth is likely to persist if the Federal Reserve maintains a relatively accommodative policy stance; however, risks from inflationary pressures and trade frictions warrant close monitoring.