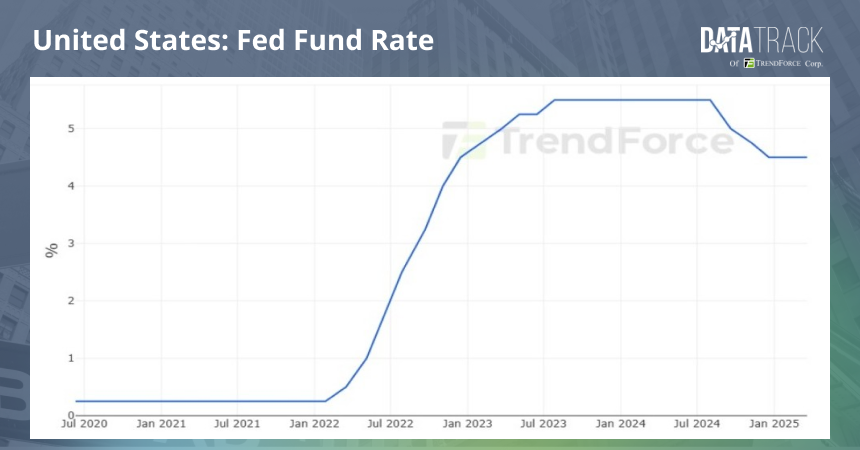

The U.S. Federal Reserve voted to maintain the federal funds rate at 4.25%–4.50% On March 19, in line with market expectations.

Statement: Outlook Uncertain, QT Slowed to 40B/Month

In its policy statement, the Fed reaffirmed its assessment that the economy continues to expand moderately, the labor market remains resilient, and inflation is still somewhat elevated. However, it removed its prior language stating that the risks to employment and inflation goals were “broadly balanced,” replacing it with “uncertainty surrounding the economic outlook has increased.” This change reflects growing concerns over the ongoing fiscal consolidation, evolving immigration policies, and volatile tariff announcements.

On monetary policy, the Fed reiterated that it will “carefully assess incoming data” before deciding on further policy adjustments. In parallel, the Fed announced it will continue reducing its balance sheet but will scale back the pace of QT starting in April. The cap on monthly runoff of Treasury securities will be lowered from $25 billion to $5 billion, while the agency debt and MBS cap will remain at $35 billion. This reduces the monthly QT pace from $60 billion to $40 billion.

Economic Projections: GDP Cut, Inflation & Jobless Rate Up, Two Rate Cuts Expected

In the Summary of Economic Projections (SEP), the Fed downgraded its real GDP forecasts to reflect increased policy-related uncertainty. Growth is now projected at 1.7% for 2025 (prior: 2.1%), 1.8% for 2026 (prior: 2.0%), and 1.8% for 2027 (prior: 1.9%). The unemployment rate was slightly revised up to 4.4% for 2025, with 2026 and 2027 unchanged at 4.3% and 4.2%, respectively.

On inflation, PCE inflation was revised up to 2.7% in 2025 (prior: 2.5%) and to 2.2% in 2026 (prior: 2.1%), while remaining at 2.0% for 2027. Core PCE was revised up to 2.8% in 2025 (prior: 2.5%), with no changes for 2026 (2.2%) and 2027 (2.0%). These revisions reflect the Fed’s assessment that recent tariff-related inflationary pressures may be transitory, but still warrant close monitoring.

(Source: Fed)

In terms of the policy path, the median dot in the dot plot projects a year-end federal funds rate of 3.875% in 2025 (down 50 bps), 3.375% in 2026, and 3.125% in 2027, with the long-run neutral rate at approximately 3.0%, broadly consistent with the December projection. The Fed thus reaffirmed its gradual easing outlook.

However, the distribution of dots showed increasing divergence among participants. Four FOMC members projected only a 25-bps cut in 2025 (up from three in December), and four members projected no cuts at all (up from one previously), signaling growing caution amid elevated uncertainty.

(Source: Fed)

While the Fed downgraded growth forecasts and upgraded inflation projections—mainly for 2025—it stressed that the inflation bump is likely “temporary” and driven by tariffs. The Fed continues to believe inflation will gradually return to target. Labor market resilience underpins the Fed’s expectation for moderate growth rather than recession.

The Fed’s current posture reflects confidence in the economy’s underlying strength, despite acknowledging that the outlook has grown more uncertain due to fiscal tightening and tariff risk. This provides a data-dependent rationale for maintaining a “wait-and-see” approach.

Post-Meeting Press Conference Q&A Highlights

Q1: Why was the inflation forecast revised upward? Was it mostly due to tariffs? Does this mean the Fed views the inflation spike as transitory?

A1: It’s difficult to isolate the tariff contribution to inflation. Goods inflation has indeed picked up, but disentangling tariff-related from other sources is challenging. If tariff-driven inflation proves short-lived and self-correcting, the Fed sees no need to overreact with policy tightening.

Q2: Does the Fed still consider long-term inflation expectations to be “well-anchored”? How does recent weakness in consumer confidence factor into the Fed’s outlook?

A2: The Fed monitors a range of inflation expectation indicators—market, consumer, business, and professional forecasters. While short-term expectations have risen—likely due to tariff concerns—longer-term expectations remain stable near 2%. Weak confidence reflects rising uncertainty, but actual economic data (jobs, spending, GDP) remains solid. The Fed is watching for signs that soft data might spill over into hard data.

Q3: The Fed misjudged “transitory” inflation during the pandemic. Could this tariff-driven inflation also be underestimated?

A3: If inflation pressures are temporary and self-limiting, the Fed doesn’t intend to over-tighten. That said, drawing this line is difficult in real-time. Lessons from the pandemic make the Fed more vigilant about structural inflation risks, and it will continue to monitor for broader inflation persistence.

Q4: The Fed once reacted strongly to a rise in long-term inflation expectations in the University of Michigan survey. With this indicator rising again, does the Fed still give it weight?

A4: The Fed does not base decisions on one survey alone. While the Michigan survey shows elevated readings, other measures remain anchored. The Fed considers the broader landscape and current trends more indicative than any one datapoint.

Q5: Is the QT taper temporary until the debt ceiling issue is resolved, or is this a longer-term adjustment?

A5: While the original trigger was concern about TGA volatility, the broader consensus within the FOMC supports a slower pace of QT to ensure a smoother path. This move is consistent with the Fed’s stated principles and does not signal a shift in monetary policy stance or a change to the long-term balance sheet target.

Comparison of the March and January FOMC Statements

Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance. Uncertainty around the economic outlook has is uncertain, and inreased. The Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. Beginning in April, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion. The Committee will maintain the monthly redemption cap on agency debt and agency mortgage-backed securities at $35 billion. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Susan M. Collins; Lisa D. Cook; Austan D. Goolsbee; Philip N. Jefferson; Adriana D. Kugler; Alberto G. Musalem; and Jeffrey R. Schmid; and Christopher J. Waller. Voting against this action was Christopher J. Waller, who supported no change for the federal funds target range but preferred to continue the current pace of decline in securities holdings.