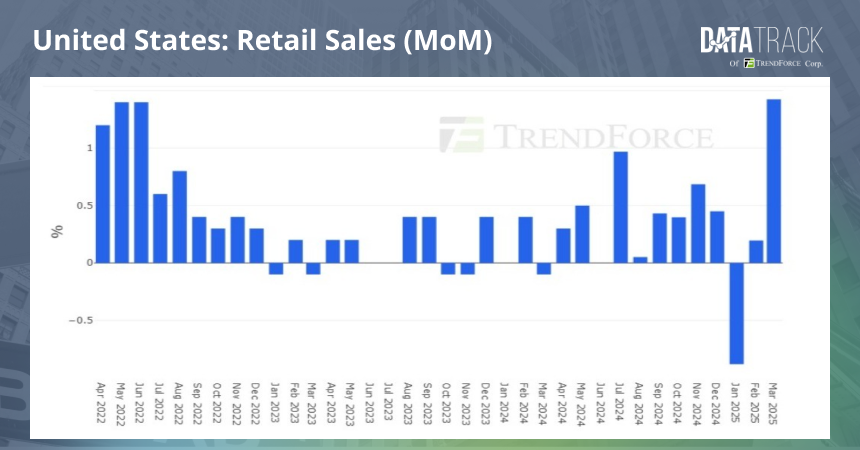

US retail sales rose 4.6% year-over-year in March (prior: 3.5%), while monthly sales jumped by 1.4% (prior: 0.2%), according to U.S. Census Bureau on April 16.

Across the 13 major retail categories, 11 posted gains, with growth mainly driven by sales of automobiles, building materials, and electronics. Auto-related sales surged 8.8% YoY (prior: 2.3%) and 5.3% MoM (prior: -1.6%), reflecting both dealer and consumer front-loading activity ahead of the end-March auto tariff announced.

Sales of building and garden materials (+3.3% MoM), sporting goods (+2.4%), and electronics (+0.8%) also accelerated noticeably. This trend partly reflects continued preemptive purchases by firms and consumers in anticipation of potential tariff shocks.

Additionally, as retail sales are not inflation-adjusted, part of the increase in nominal sales likely reflects price markups—particularly on Chinese imports that were subject to tariffs and subsequently passed on to final retail prices, rather than real volume gains.

Food services and drinking places—often used as a proxy for household financial health—recorded YoY growth of 4.8% (prior: 2.7%) and MoM growth of 1.8% (prior: -0.8%), the fastest pace since 2023.

This reflects not only a rebound in outdoor activity amid warmer weather, but also suggests that consumers remain willing to allocate discretionary income toward services spending, even amid falling confidence and equity market volatility.

Excluding autos and gasoline, core retail sales rose 4.5% YoY (prior: 4.2%) and 0.8% MoM (prior: 0.8%). After further excluding food services and building materials, control group retail sales grew 4.6% YoY (prior: 5.1%) and 0.4% MoM (prior: 1.3%), indicating that underlying consumption remains moderate.

Overall, the sharp rise in March retail sales was largely driven by tariff-induced front-loading. While reciprocal tariffs have been temporarily suspended for 90 days, uncertainty remains, and such preemptive restocking and elevated sales growth may persist into Q2. However, a slowdown could follow in the second half of the year as demand is pulled forward.

Following the data release, markets shifted expectations for the first rate cut to June, pricing in a total of 100 basis points of cuts for the year.

However, Fed Chair Jerome Powell, in a speech delivered yesterday, cautioned that tariff pass-through to consumer prices takes time and emphasized the need for further observation to ensure that tariff effects on inflation are transitory and that long-term inflation expectations remain anchored.

He reiterated that the Fed prefers to wait for more data before considering any policy adjustments, particularly given the currently favorable economic environment.